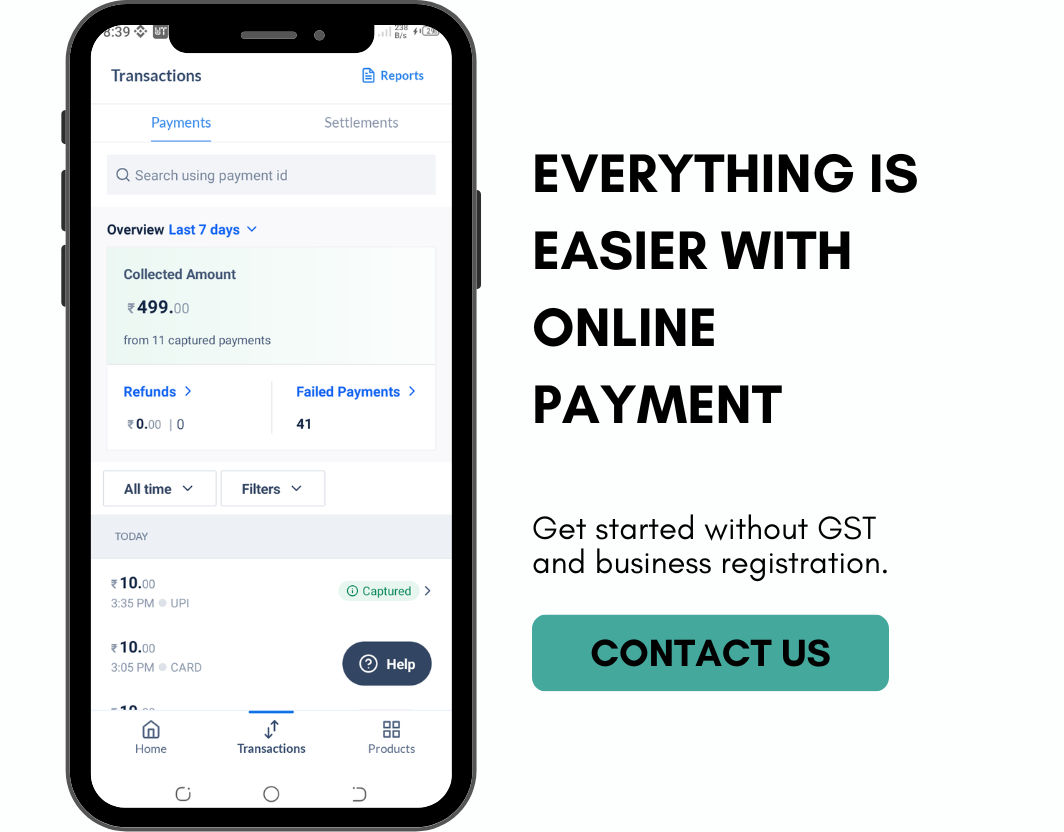

Payment Gateway

Without GST

Unlock seamless online transactions without the complexities of GST registration with our specialized Payment Gateway Onboarding service. We understand that not everyone has a GST registration, and that shouldn't hinder your business growth.

Create Payment Link

Create Payment Link